The £100,000 Startup Race Syndicate

Commitments close: 31 March 2026

Proposed Start: 2 April 2026

Investment: 2 April 2027

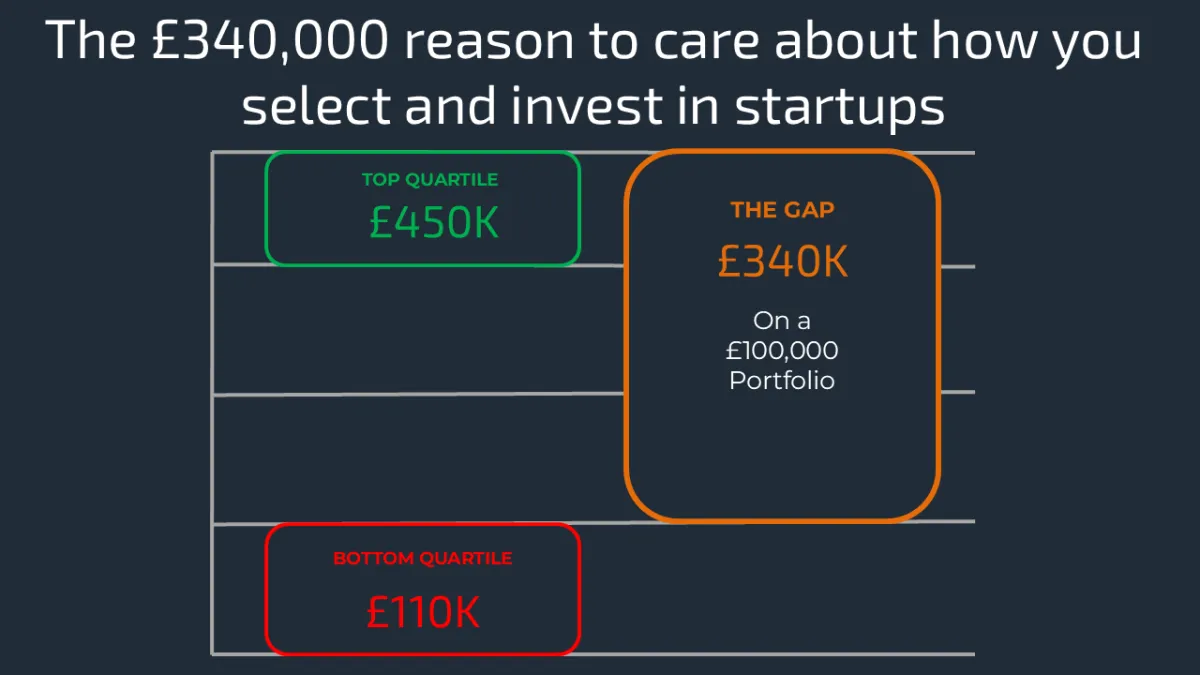

Why This Matters: The £340,000 Reason to Care About Selection

Research across 3,097 angel investments shows something that should change how every angel thinks about their first check:

Due Diligence Time

Less than 20 hours

20–40 hours

40+ hours

Return Multiple

1.1X

5.9X

7.1X

Failure Rate

60–65%

~50%

~45%

Top-quartile angels turn £100,000 into approximately £450,000. Bottom-quartile angels barely break even at £110,000. Same asset class. Same time period. Same market conditions.

The difference is information quality at point of investment

Traditional due diligence creates a point-in-time snapshot built from founder claims and curated references. The Startup Race creates 52 weeks of verified, competitive, longitudinal performance data - more real observation than any due diligence process can produce.

Want more detail or information on the research? Read our Investor Memo here

The £100,000 Startup Race Format in Plain Terms

Who competes: 50 founders, each with £5,000+ Annual Recurring Revenue before they enter. They already have paying customers.

How they're ranked: Verified revenue pulled directly from business bank accounts via accounting software. No self-reporting. No manipulation.

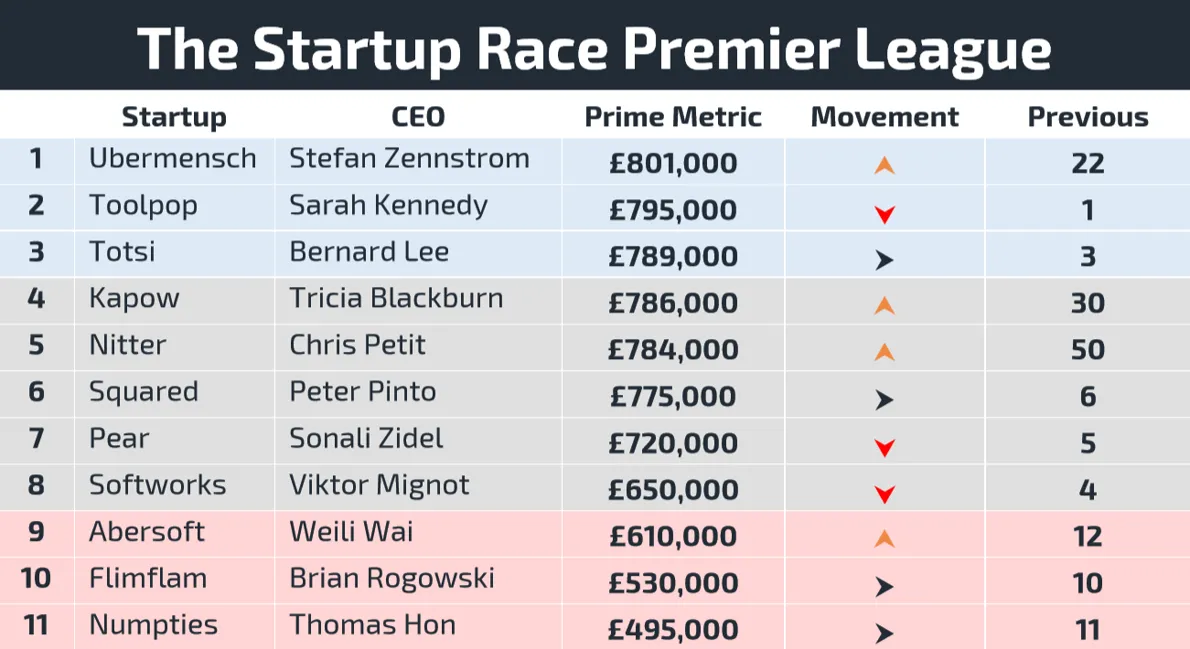

The structure: A Premier League of the top 10, updated weekly on a public leaderboard. Drop out of the top 10? Fight your way back in.

The winner: The founder who generates the most cumulative revenue over 52 weeks wins £100,000 investment from the syndicate.

What you watch: Not a pitch. Not a presentation. You watch how 50 founders respond to competitive pressure, bad months, ranking drops, and a full year of accountability.

What Watching Actually Feels Like

Picture this: It's Monday morning. The league table updates.

That founder you've been watching? Three weeks ago they were 3rd. Then 7th. Then 9th - three brutal weeks of declining sales while you watched them scramble to figure out what broke.

This week? Back to 6th. Next week, 4th. The week after, 2nd.

Not through luck. Not through pivoting their story. Through relentless customer acquisition - twenty new customers in three weeks while their competitors made excuses about market conditions.

You didn't read about their resilience in a reference check. You watched it happen, week by week, for six months.

By April 2027, you're not evaluating a pitch deck. You're backing a founder whose character you've already observed under sustained competitive stress.

This is a fundamentally different investment experience.

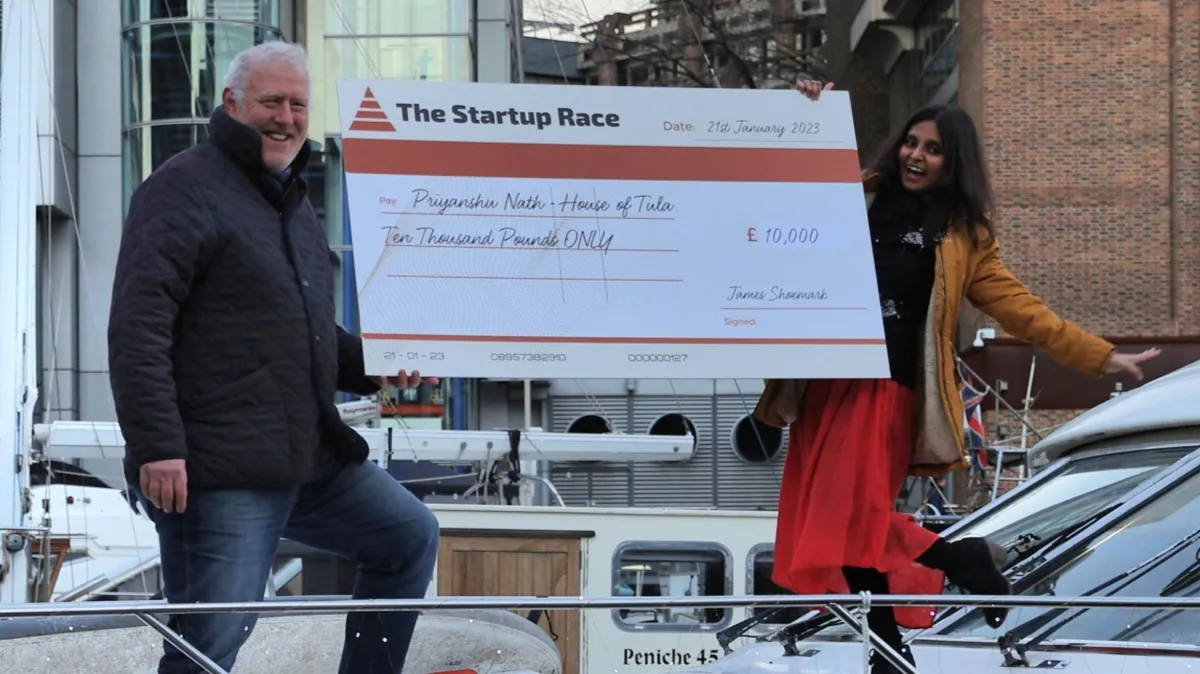

The Track Record

This methodology has been tested. Three times.

Competition

£10,000 Race (2022)

Runner-up (2022)

£1,000 Race (2020)

Winner

Priyanshu Nath

Mariely Macias Olmedo

Jonas Virsilas

Revenue Growth

44X

17X

12X

Status

Still trading

Still trading

Still trading

To be clear: these are revenue growth figures during competition, not investment returns. What they show is that the methodology works - public competition, verified metrics, and sustained observation produce exceptional execution from founders who thrive under pressure.

Two Ways to Participate

Investment Prize Provider - £5,000 to £10,000

The primary route into the founding syndicate.

Your contribution combines with 10–20 other experienced angels to create the £100,000 investment prize. You watch the full 52-week race. You invest when it concludes.

What you get:

Pro-rata SEIS-eligible equity in the winning startup

Your name on the cap table - not behind a nominee

Full Premier League dashboard access throughout the race

Monthly investor updates with analysis and observations

First opportunity to invest additional capital in top performers

Priority access to the £1,000,000 Startup Race (founding syndicate only)

What you commit to: A Commitment Letter confirming your intended contribution. Not a legally binding contract - but a genuine commitment the winning founder will rely on. No money moves until April 2027.

Race Observer - No investment commitment

Watch the full race. Invest in any participant that interests you directly.

Full league table access for all 50 startups. 52 weeks of verified performance data. Freedom to approach any founder for direct investment discussions at any point during or after the race.

The Investment Structure

Element

Individual contribution

Tax wrapper

Syndicate lead co-investment

Syndicate lead carry

Timeline

Detail

£5,000–£10,000

SEIS (Advance Assurance obtained after week 30)

£10,000

10% of profits

52-week competition → investment on or around April 2027

We co-invest £10,000 alongside you. The 10% carry on profits is standard for led syndicates and ensures alignment - we only succeed when you succeed.

SEIS: The asymmetry that makes early-stage investing rational

For a 45% taxpayer investing £10,000:

50% income tax relief: £5,000 returned immediately

If the company fails completely: 45% loss relief on remaining £5,000 = £2,250 returned

Maximum actual loss: £2,750 — 27.5% of original investment

If the company succeeds: uncapped gains, zero CGT

Tax treatment depends on individual circumstances and may change. The winning startup will hold SEIS Advance Assurance. Seek professional advice.

Why Direct Investment Matters

Each investor in the Startup Race syndicate invests independently in the winning company. You subscribe for your own shares. You appear on the cap table. You receive your own SEIS3 certificate.

This is the same structure used by Cambridge Angels and Archangels — individual shareholding with no pooling of assets. Each member makes a completely independent investment decision.

This means FCA compliance without authorisation (we rely on Articles 48 and 50A of the Financial Promotion Order, the same self-certification exemptions established syndicates use), clean SEIS treatment with no fund structure complications, and a direct relationship with the company.

What the Startup Race coordinates: Ensuring the winner has SEIS Advance Assurance before investment; timing so all syndicate members invest together; liaising with the winning company on Form SEIS1; chasing your SEIS3 certificate; facilitating introductions if you want to invest further in top performers.

The investment itself is yours. Direct. Independent. Clean.

The Process: Seven Steps

Step 1: Express Your Interest

Complete the short form. This is the low-friction first step - it doesn't commit you to anything and doesn't trigger any money movement.

Step 2: Self-Certification

Complete either a High-Net-Worth Individual or Sophisticated Investor statement. FCA regulations require this before we can send you investment communications. If you've invested through syndicates before, you've done this many times.

Step 3: Submit AML/KYC Documents

Confirm your identity to comply with Anti-Money Laundering and Know Your Customer regulations. Standard practice for angel syndicates. Upload ID and proof of address via our website or email copies directly.

Step 4: A 20-Minute Call With James

Partly to meet you - the syndicate is small and we'd like to know who's in it. Partly to answer any questions. Partly to complete identity verification (passport, proof of address, PEP confirmation — standard AML practice for angel syndicates).

Step 5: Sign Your Commitment Letter

A Commitment Letter capturing your intended contribution (£5,000–£10,000). Not a legally binding contract, but a genuine commitment we rely on. You can read the template here.

Step 6: Watch the £100,000 Startup Race (April 2026 – March 2027)

Weekly league table access. Monthly investor updates. Watch 50 founders compete under observation. Check in as much or as little as you like. No money moves during this period.

Step 7: Final Verification + Invest (March/April 2027)

Source of Funds declaration and PEP status refresh before funds move — standard compliance. Then: Subscription Agreement with the winning company. Fund transfer directly to the startup. Share certificate issued. SEIS3 coordinated.

That's it. Seven steps. One investment in a founder who proved themselves over 52 weeks.

Timeline: Key Dates

Milestone

Prize Provider recruitment

Commitment Letters confirmed

Race begins

Weekly league tables published

Race concludes

Investment into winner

Date

Now – Q1 2026

By March 2026

April 2026

Throughout 2026–2027

March 2027

On or around April 2027

The £100,000 Startup Race Is For Investors Who:

Have grown frustrated with pitch-based selection and want a better signal

Believe behaviour under pressure predicts performance better than presentations

Want to observe founders compete (publicly, verifiably) before committing capital

Value 12 months of revenue data over 12 slides of projections

Understand early-stage investment risk and appreciate how SEIS mitigates it

This Is Not For Investors Who:

Prefer to be hands-on during the selection process

Want to invest in companies at later stages with proven market position

Are looking for immediate liquidity

Prefer traditional pitch-based evaluation with direct access to founders before investment

Need investments that can be exited quickly

Early-stage investing carries significant risk, including loss of capital. SEIS tax relief mitigates but doesn't eliminate this risk.

Join the Founding Syndicate

Once you have provided your contact details, you'll gain access to the self-certification form immediately.

Questions before committing?

Option 1 - Read our investor memo

Option 2 - Schedule a call with James

FCA Requirements

To participate, you must self-certify as a High-Net-Worth Individual or Sophisticated Investor.

High-Net-Worth Individual: Annual income of £100,000+ OR net assets of £250,000+ (excluding primary residence and pension).

Self-Certified Sophisticated Investor: Member of an angel network for 6+ months, made 2+ investments in unlisted companies in the past 2 years, worked professionally in private equity or SME finance, or served as director of a company with £1.6m+ turnover.

This page is for information only and does not constitute investment advice. The Startup Race Ltd is not arranging an investment deal. Investment in early-stage companies involves significant risks including illiquidity, lack of dividends, and potential total loss of capital. Tax reliefs depend on individual circumstances and may change. Please seek independent professional advice before investing.

© Copyright The Startup Race 2026